Best-in-class yields

Automated vaults find best-in-class yields while mitigating risk.

Explore Vaults

(Coming soon)

Market adaptive vaults provide a unique edge and improved risk mitigation.

Let automated vaults do the optimization for you.

Explore Vaults

(Coming soon)

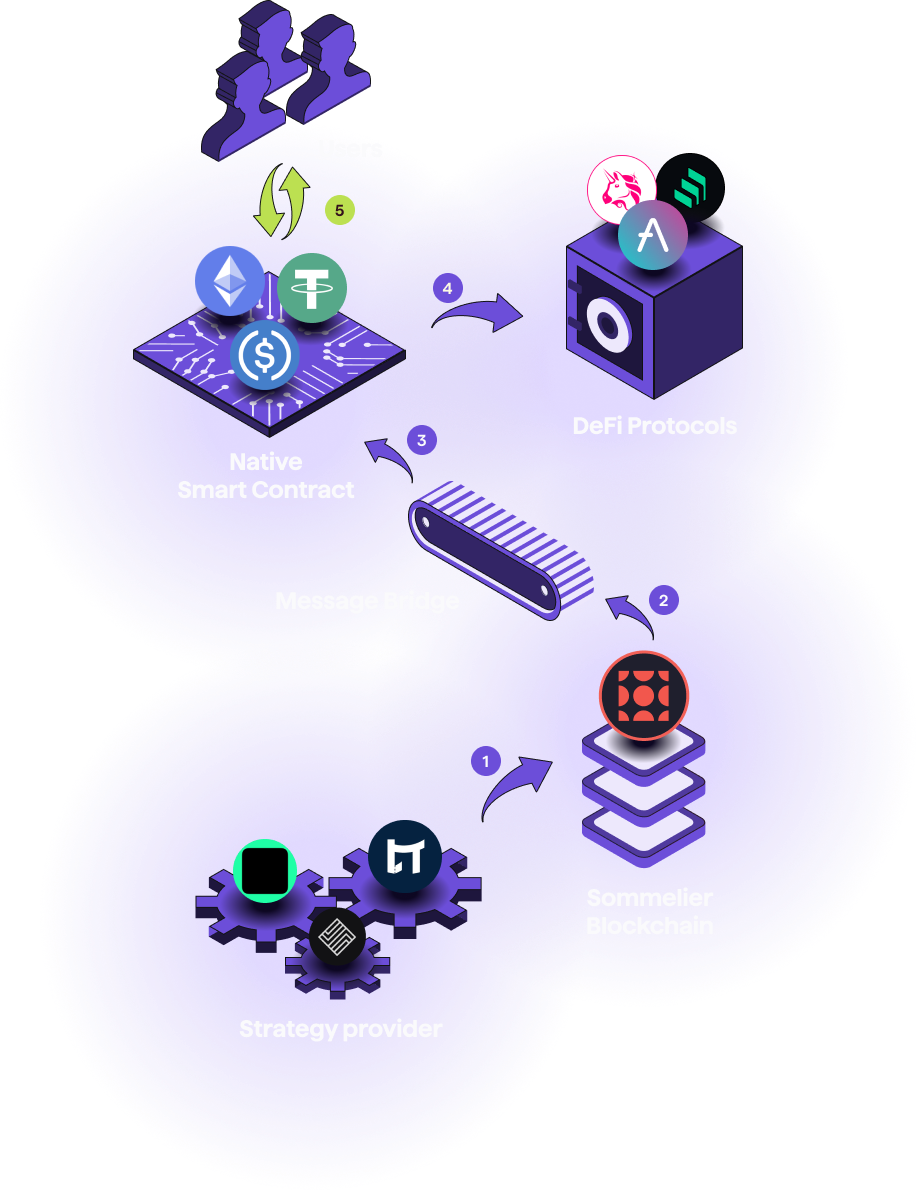

How it works

1

Strategist runs model off-chain and sends rebalance message

2

Sommelier blockchain reaches consensus on rebalance message

3

Rebalance message is transmitted to vault contract

4

Vault contract executes rebalance

5

Users are the only ones with the ability to deposit or withdraw

Secure

The protocol is designed with multiple safeguards in place, ranging from those encoded in the vault smart contracts to the validator set, which acts as a guardian between users and strategists.

Decentralized

No single entity has control over the protocol. The validator set reaches consensus on the rebalances executed on-chain and SOMM token holders control protocol governance.

Adaptable

The protocol was designed to be secure but flexible, allowing vaults to adapt to market conditions. The vault's adaptability is due in large part to the ability to utilize off-chain computation and indicators to optimize rebalances.

Secure architecture

Audited Smart Contracts

All smart contracts have been independently audited and Sommelier has an active bug bounty program.

Validator Oversight

Vaults are managed by the Sommelier validator set instead of a multi-sig. Users are the only ones who can withdraw assets.

Approved Through Governance

All Sommelier vaults and their smart contracts are first approved through community governance before being onboarded to the protocol.

Smart Contract Controls

Validators can only move assets among the prescribed positions encoded in the vault smart contract.

Multi-Chain Without Bridged Assets

Sommelier functions on multiple chains by using bridges to pass rebalance instructions to its vault smart contracts. Importantly, no assets are bridged in this process, only the details on how the vault should rebalance.

Investors

© 2024 Sommelier by Bajanss OÜ –Maakri 36-50, Tallinn, Estonia 10145