Sommelier Liquidity AMA with Dereek69 & Shalaquiana from BIOPset

Follow Taariq Lewis as he interviews some of the up and coming projects in crypto, to gain insights on becoming a profitable Liquidity Provider for Uniswap V3. BIOPset is the the on-demand, censorship-resistant, peer-to-pool binary options settlement protocol. Today we were joined by Core Developer Shalaquiana and Head of Tokenomics Dereek69.

BIOPset, New Binary Options Project, Offers Opportunities for Liquidity Providers

Binary options is a complex space. On June 11, it got a little more promising for liquidity providers when BIOPset, a project on binary options, launched Uniswap liquidity rewards for liquidity providers for the BIOP Ethereum pair on Uniswap v2 on Ethereum blockchain. Co-founders Dereek, Head of Tokenomics, and Shalaquiana (“Sha”), Head of Development, discuss their project.

Sha says: “We are co-founders of BIOPset. Our name is a version of ‘binary options settlement’ on Ethereum blockchain. It’s entirely public, entirely decentralized from day one. All of the functionality is on-chain, from the liquidity to option creation to option settlement, which is one of our most defining features. We have designed our system so that anyone, anywhere can earn a risk-free income by helping settle other people’s options. That’s our key justifying point. And, our options are currently built on top of Chain Link’s oracles.”

Dereek observes: “Our main benefits against our competitors that are centralized binary options currently are that we have very low fees, about 10 times lower than the centralized competitors as they usually reward 85-90 percent of the win to the betters, while we reward up to 98 percent. And, we cannot be shut down or regulated because even if the website doesn’t work you can always use BIOPset directly from the Ethereum contracts. And we have no limitation regarding the size of the options. Most platforms have requirements and so they will rule out a lot of people that cannot afford a minimum amount. Any option can be opened on BIOPset on the lower side. On the upper limit, the only limit we have is regarding the liquidity in the pool.

Right now BIOPset is made possible by three types of users, Dereek explains:

“The first is, of course, traders. They open and close options and they don’t need a counterparty because the liquidity providers are the counterparty for the traders and they are rewarded with the BIOP token for providing liquidity to the platform. And, then there are the settlers that will close every open option when it’s time to close them and they will earn a share of the fee by doing so.”

The competition

Over the past few weeks, BIOPset’s team has been diving in and analyzing competitors. Sha observes:

“A large number of our ‘competitors’ don’t have products. Of the ones that do, the ones that are closest to us are Spectre AI, except they require accounts, they require deposits before you can make a trade, which removes all of the centralized aspects we’re going for. In addition to them there’s Value Network Live. But as far as I can tell they’re mostly operating on Binance Smart Chain and not Ethereum. They also seem to have larger option timelines than we focus on. Our options are focused on shorter time lines. The only remaining competitor that seems to have any type of working product is Divergence and they’re definitely our biggest competitor.”

The edge is that 98 percent of fees come back to liquidity providers. Dereek explains::

“When they are out of the money the entirety of the option goes to the liquidity provider, while when they’re in the money 98% of the options goes to the winner of the bet.

Progress and opportunities for liquidity providers

Currently, BIOPset is waiting for the code audit to launch its full platform on which participants will be able to provide liquidity for the BIOPset platform. Dereek says:

“We launched the Uniswap liquidity rewards on June 11, where we will reward liquidity providers for the BIOP Ethereum pair on Uniswap v2. Learn more by coming to our Discord. Website: biopset.com.”

Looking ahead, Dereek considers Uniswap v3 in BIOPset’s future. He says:

“We are looking to give rewards to Uniswap v3 but we’re not looking to do this right now. Our plan is to wait for Uniswap v3 on Layer 2 or for the locking period to end and to look at the market and decide what to do then. Currently, the locking period was three months starting from listing, which was in May.

“Currently, the plan is for the launch to incentivize trading as well as liquidity providing the most because we need volume for the liquidity providing to be effective. As soon as we have enough volume or the rewards for the liquidity providers are maybe a bit lower ahead of time, we are going to probably change the fee structure to reward them more for out-of-the-money options."

Active participation in the DAO is something already structured from the outset in BIOPset. A commitment to community is also a key pillar for why this will be successful.

The market opportunity: Freedom, access to more fees, and fewer intermediaries

Sha describes the current market for his company and the opportunity it presents for liquidity providers. He/She says:

“The current binary options centralized market is $1.25 billion a year globally, and our options are offering a higher return than any centralized binary option available anywhere. The highest centralized binary option returns are 90% and we offer up to 99% if you settle your own option. Which, we see is a dramatic step up for users who want to trade options and not lose their fees to centralized oligarchies dominating the binary option world.”

“Our team has already grown a lot,” notes Dereek. “Originally, it was just me and Sha and now we are I think six or seven members working on it.. And, I’m pretty sure we are going to grow quite a lot more in the following months. We are already looking for a web developer.

Sha encourages front-end web developers to reach out. He/She says:

“If you’re listening to this and you’re a front-end web developer, especially with experience building PWAs or SPAs, then come and contact us. We are ready to hire immediately. Outside of that our main focus is to grow the community through utilization rewards. They are set up so that the majority of buyout tokens in existence will be distributed to the users of the platform. We want to make sure that the people who care about it and want it to exist are the ones that control it and ultimately will be administering it through the settlement long-term.

“One thing I’d like to say is there are a number of competitors that exist in the decentralized space that don’t have products -- I’m not going to name them -- but they have tokens, they’ve been in development for twice as long as we have with no product, they are not ready, they don’t even have a test net version and their tokens are valued at 20x the current price of our buyout token. So, if you’re looking for some alpha, this is it.”

Considering price and BIOPset’s active community this should be one to watch. If you’re looking for BIOPset on Uniswap v2 you can check out Sommelier’s v2 version and, of course, as staking rewards come online we will be there for Uniswap v3 as well.

More articles

Is Speculation Killing Crypto’s Future?

Sommelier's Path Forward: Embracing Revenue Over Narrative

Sommelier January Update

Sommelier Upgrades Cellar Architecture to Enable the Most Powerful DeFi Strategies in the Market

Real Yield USD is Coming to Maximize Stablecoin Yield

Retrospective on 2022 and the Journey Ahead

FAQ - Patache Digital’s Steady Strategies

Patache Digital: Risk Management Discussion

Strategy Deep Dive: Patache Digital

Strategy Provider Spotlight: Patache Digital

User Guide: How to Participate in Strategies on Sommelier

Sommelier Ambassador Program

Strategy Tokens: What Are They and How Do They Work?

6 Core Principles of Sommelier

10/10/22 - Deep Dive on Cleargate Backtesting

Strategy Provider Spotlight: Seven Seas

Deep Dive on Trend and Momentum Strategies

Strategy Provider Spotlight: ClearGate

Supporting Strategy Providers on Sommelier

Sommelier Protocol Team Weekly Update #11

ELI-5 Explanation of the Data Science behind Sommelier’s First Aave Cellar

Sommelier Protocol Team Weekly Update #10

The Data Science Behind Sommelier’s First Aave Cellar

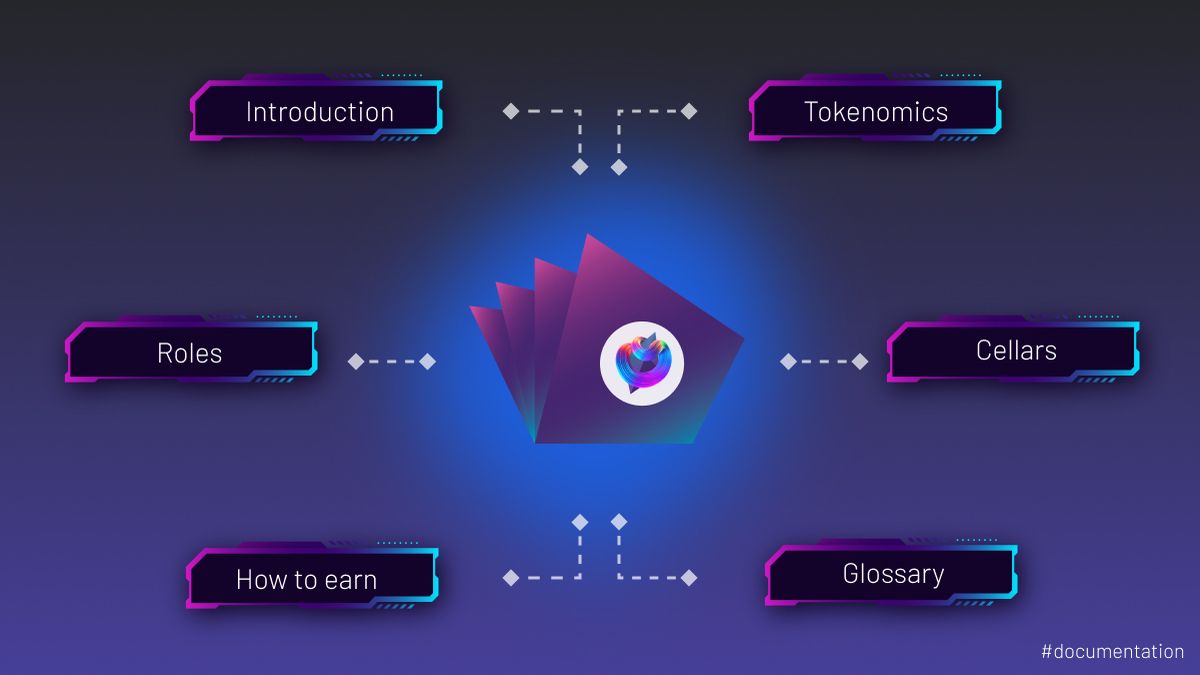

Sommelier Protocol Design Documents

Sommelier Protocol Team Weekly Update #9

Sommelier Protocol Team Weekly Update #8

Sommelier Protocol Team Weekly Update #7

Twitter Spaces With Sommelier: How to Launch a Cellar on Sommelier

Twitter Spaces With Sommelier: Protocol Upgrade and Community Update

Sommelier Protocol Team Weekly Update #4

Sommelier Protocol Team Weekly Update #6

Twitter Spaces With Sommelier: SOMM Airdrop Proposal Data Analysis

Twitter Spaces With Sommelier: Community Update on the First Cellars to Launch

Twitter Spaces With Sommelier: Exploring NFT Cellars

Sommelier Protocol Team Weekly Update #1

Sommelier Protocol Team Weekly Update #2

Sommelier Protocol Team Weekly Update #3

Three Things You Need to Know About Sommelier Governance This Week

Sommelier On the Road: PROOF OF…REPUTATION

Introducing Ukpai Ugochi - Working on The Sommelier Cellars Rebalancer

Sommelier Announces 23MM Series A Mainnet Round to launch Automated DeFi via the Cosmos

Twitter Spaces With Sommelier: Mainnet Launch & Gravity Bridge

Twitter Spaces With Sommelier: Introducing SOMM Tokenomics

Twitter Spaces With Sommelier: Mysten Labs AMA With Evan Cheng

Introducing SIPS and Sommelier’s Governance Structure

Twitter Spaces With Sommelier: End of Year AMA 2021

Twitter Spaces With Sommelier: Intro to SIPS & Lisbon Blockchain Week

Twitter Spaces With the Sommeliers: Mainnet Update and Governance Launch

Sommelier Partners With Mysten Labs to Make Sommelier and All Cosmos Blockchains the Fastest Protocols on the Planet

Twitter Spaces With the Sommeliers: Sushi AMA With Joseph Delong

Introducing the Sommelier Network Mainnet and Ethereum Gravity Bridge

The Top Five Features of the Sommelier Protocol

Call for Validators: The Two Step Process for 2021

Two New Features Launched to Test Liquidity Management on Uniswap v3

Uniswap v3 Remove Smart Contract Incident Post Mortem for Sommelier

Call for Validators: Road to Sommelier Mainnet

Sommelier Liquidity AMA With Yenwen and Nick From Perpetual Protocol

Sommelier Liquidity AMA With Tascha Pan From Alpha Finance

Sommelier Liquidity AMA With Loi Luu From Kyber Network

Sommelier Liquidity AMA With Alex From Peanut

Sommelier Liquidity AMA With JP From THORChain

Sommelier Liquidity AMA With Alan Chiu From OMGX Network

Sommelier Liquidity AMA With Ari From Gelato Network

Sommelier Liquidity AMA With Sunny Aggarwal From Osmosis

A Fine Sommelier Explanation of Bollinger Bands With Kevin Kennis

Sommelier Liquidity AMA With Mona El Isa From Enzyme

Sommelier Liquidity AMA With Haxor From Method Finance

Sommelier Liquidity AMA With Tor From Secret Network

Liquidity Provider Insights With Zaki Manian - Ep. 7 - DeFi Automation Space on Uniswap v3 and Where Sommelier’s Heading

Sommelier Liquidity AMA With Geralt From CyberFi

A Pairings Tutorial of Two Sided Liquidity Addition with Sommelier

Liquidity Provider Insights with Zaki Manian - Ep. 6 - Liquidity Providers Need to Gear Up for a Multi-Chain World

Three New Summer Features for Liquidity Providers

Sommelier Liquidity AMA with Tom C and Max W from Charm

Sommelier Liquidity AMA with Dereek69 & Shalaquiana from BIOPset

Sommelier This Week - June 3rd 2021: The Road to Mainnet

Sommelier Liquidity AMA with Federico Landini from DefiLab

Sommelier Liquidity AMA with Michael Egorov from Curve

Liquidity Provider Insights with Zaki Manian - Ep. 5 - A Bright Light at the End of a Long, Tough Weekend for Bitcoin

Sommelier This Week - May 27th 2021: What Aspiring Sommelier Validators Need to Know on Last Week’s Protocol and App Progress

Liquidity Provider Insights with Zaki Manian (Special Edition) - Ep. 4 - New Pairings Release

Sommelier R&D AMA With Yaniv Tal From the Graph

Sommelier Liquidity AMA with MacLane Wilkison from NuCypher

The Eight Steps to Become a Liquidity Provider with Pairings

Sommelier NFT Awards - May 18th, 2021

Pairings By Sommelier: The FAQ

Zaki Manian Breaks Down What Liquidity Providers Need to Know Under Uniswap v3

Sommelier This Week - May 6th 2021: How This Week’s Protocol and App Progress Weaves Together to Make a Product

Sommelier Liquidity AMA with Dan Thomson from InsurAce

Sommelier This Week - April 29th 2021: Weeks Away From a Taste of the Sommelier App Experience and How the Dev Team Stays on Track

Zaki Manian Breaks Down a Phase Change Liquidity Providers Need to Know About Automated Market Makers

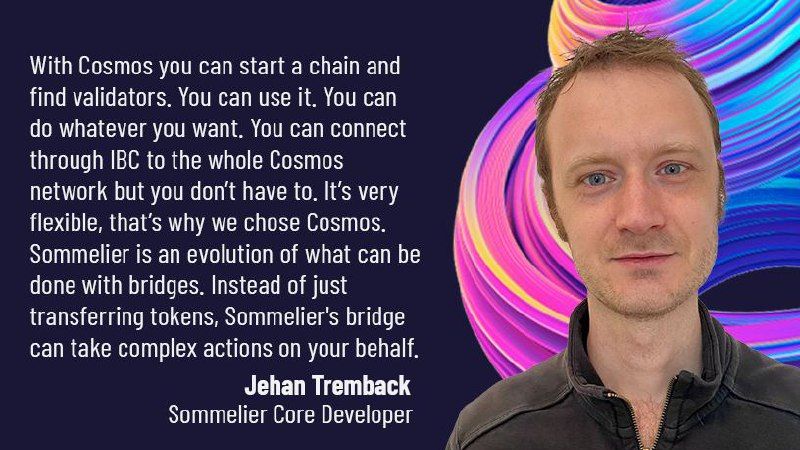

Introducing Jehan Tremback: Sommelier Core Developer and Althea Co-Founder that pushes the Limits of the Blockchain Bridge with Gravity

Sommelier This Week - April 22nd 2021: An Inside Look at Progress on Coordinating Sommelier Components That Contribute to the Chain

Sommelier This Week - April 15th 2021: Providing a Best-in-Class Experience for Uniswap Liquidity Providers

Sommelier Announces $1M R&D Grant from The Graph Foundation

Introducing LP Rewards: This Week With Cellframe

Introducing Deborah Simpier: Althea CEO and Sommelier Co-Founder Who Brought the Gravity Bridge to Life in The Cosmos

Sommelier This Week - April 8th 2021: What Uniswap v3 Means For Sommelier Architecture and Validators

Introducing Sommelier LP Rewards Program

Sommelier This Week - April 1st 2021: Gravity Bridge and Private Testnets

Blockchain startup decides to acquire a California winery and host NFT wine parties

Introducing Justin Kilpatrick: The Blockchain Bridge Wizard Who Maintains Gravity

Five Ways UniswapV3 changes the world for Liquidity Providers on the AMM

Introducing Jack Zampolin: On Becoming A Sommelier in The Cosmos

Sommelier: Welcome To The New CoProcessor For Ethereum

© 2025 Somm by Bajanss OÜ –Maakri 36-50, Tallinn, Estonia 10145