Sommelier On the Road: PROOF OF…REPUTATION

I minted an Unbearable Bear NFT to get into DeFiCon last weekend in an under heated, godforsaken warehouse in Bushwick, Brooklyn, with 200+ other DeFiers. Below, I summarize the comments of Hester Peirce, SEC Commissioner, and Alex Mashinsky, CEO of Celsius. I list a few worthwhile quotes from other presenters. First, five big take-aways:

Sommeliers On The Road at DefiCon Brooklyn Dec. 18-19, 2021

BIG BAGS: Institutions are keen to get into DeFI – but lack of privacy and trusted tools hold them back. Solve for privacy and trust and wait for the tsunami.

Although I agree there will be no one chain to rule them all, tech markets tend to coalesce around standards. The ground in DeFi is still hotly contested – but one day there will only be a few layer 1 winners sharing the spoils. When balancing speed against perfection, founders should lean toward General Patton’s advice: “A good plan violently executed now is better than a perfect plan executed next week.”

BIG BROTHER: While the US is more crypto friendly and flexible than China, and while we have courageous voices in the wilderness (Hester Peirce at the SEC, Wyoming), the hesitation or outright over-reach of a majority of regulators (yes you, Gary) mean that pushing elements of your DeFi project offshore - and sometimes the whole show – is often the prudent way to go. But don’t give up – make noise!

POACH THE STREET: There is an astounding lack of Wall Street experience on a lot of DeFi projects looking to replace Wall Street. I get it – if you want to blow up Wall Street, why hire the guys that built it? Unfortunately, the parts of DeFi that involve human behavior (umm, most of it) are going to build on what people have been refining for millennia. You can’t redefine liquidity without knowing something about the buttonwood tree, Bretton Woods and what goes on in a giant warehouse in Mahwah, New Jersey. Put another way: if you want to beat the Patriots, you hire Tom Brady.

NFTs: too big to generalize, but a lot of this is more about forces like love, envy, peer pressure, loyalty, attraction and fun than it is about money. That means valuation can be next to impossible – and yet markets are forming around them. The ventures that make it easier to value, lend and borrow NFTs will be big winners.

Finally, IT’S NOT PoW or PoS, IT’S PoR: Community is such an overwrought word, and yet that is what we are building. You cannot build lasting communities overnight. Anons might pull it off occasionally (Bitcoin for sure, Olympus?), but most lasting settlements are founded by hard work, honesty about failures and sharing the wealth with everyone. So what we need is a new network proof: Proof of Reputation. I strongly believe that founders and early contributors are more likely to build lasting value by staking something that matters a lot more than money. That something is REPUTATION. That is only built over time – and keeping your word and how you admit and handle failure is most of it.

HESTER PEIRCE, SEC COMMISSIONER

Our job under the law is three-fold: protect investors through disclosure, protect the integrity of the markets, and facilitate capital formation. Skepticism on the part of the regulator is healthy, but “merit” regulation is not our mission. However, unfortunately, we have strayed into it. I strongly disagree with using “strategic ambiguity” and defaulting to enforcement actions as an approach to regulating this space.

On DAOs, we are looking for DINOs: decentralized in name only. The third prong of the Howie test is “based solely on the efforts of others”: so we ask: if any one person in this community got hit by a bus, would it make a difference?

On the other hand, DAOs in general are simply new replacements for venture formation (like corporations and LLCs) are thus subject to state law, not federal.

A 2010 decision, Morrison v Australia Nat’l Bank, held that US securities laws do not apply to “purely offshore” transactions. However, Chairman Gensler takes a broad view of his jurisdiction. Some have called it applying the “intergalactic Commerce Clause.”

We will of course see through half-hearted attempts to keep US citizens out. You can’t announce on your website it’s not available to US citizens and then describe on your Telegram how to VPN your way around it.

Even if you make good faith efforts, I have little comfort to give you. Most of my colleagues take a broad view of their jurisdiction.

Jason Gottlieb, attorney for Morrison & Cohen: Reeves v Ernst & Young suggest that loans can be securities. Does this apply to crypto loans?

Hester: You need counsel on that one. The presumption is that if two people enter into a contract voluntarily, the presumption is that we should not interfere.

The Safe Harbor provision that I have proposed would allow projects a three-year runway. But this is only a proposal, and you cannot rely on it now.

FUTURE OF FARMS: YIELD 2.0

Alex Machinsky, CEO, Celsius

The velocity of the dollar – daily turnover – is 1.2. The velocity of DeFi is 22. That tells you a lot.

The first killer app in crypto was store of value. The second is yield.

But here’s the problem. Yield farming is like a blind person crossing a highway. Wow, I made 25% in this lane. Next lane, a tractor trailer rug pull flattens you into its grill.

Getting people into DeFi is going to take time. We won in VoIP because 100M people showed up for the cheap calls pretty quick. Money is harder. I anticipate this will be a Thirty Years War.

Yield farming does not get us 8 billion people. 10M people got liquidated on Binance last May. That’s 10M we have to win back.

A big problem in DeFi? You are a mirror image of Wall Street. In some cases, your fees are worse.

You have to look at the teams in this space. Nexo – who are they? Can you tell me?

What is our business model at Celsius? We charge institutions for our liquidity, and pay that to our customers. We are a credit union in crypto.

I (Michael Long) asked him: Ok, you have Wall Street paying you now. One day you will have to charge your customers for your service, no?

Alex: When will Citadel stop paying for order flow? When the cows come home.

Quotable:

Ed Mehrez, co-founder Arrow Markets (on democratizing derivates)

Other than perpetuals, derivatives in crypto have not taken off. Derivatives today, which represent perhaps 10X of the planet’s entire GDP, are in the hands of a few specialists. Crypto allows us to democratize derivatives.

To get institutional money, you need two things: first, KYC on the subnets. Second, an understanding of systemic risk. The Fed makes the banks stress test. DeFi is open. We can fork an AVAX mainchain and stress test. But there is a free rider problem. Who does it? Maybe Chain Labs. We have to get ahead of the regulators.

The system almost failed a hundred years ago. JP Morgan stepped in personally, and the Fed was born. This time we have a chance for the community to propose the standard ahead of time.

Conor Carney, Legislative Director, Congress

Congressional reps are super busy. Unless they are on the right committee they don’t have the time for deep dives on crypto. But you should be reaching out to them on issues that will affect their constituents. If you think tax rates are too high or too uncertain, let them know!

Andrew “Zyori” Campbell, Axie Infinity

Axie is going from Proof of Authority to Proof of Stake. Will launch a DAO in 2023. We had to do a Ronin sidechain because of gas fees.

The typical Axie fan goes through four steps:

- This is too good to be true.

- It must be a scam.

- OMG it’s not.

- I’m in.

We have 2.5M daily active users on Axie. They are here for the game: but we can teach them other things about crypto – for example, yield.

Robbie Cochrane, Chain Guardians

90% of our users want user-friendly over decentralized. But the 10% who prioritize decentralized are VERY vocal.

James Carlyle, Obscuro (on privacy)

WhaleAPI shows every whale move on ETH. You can copy their alpha. You won’t get big tradfi bags without giving them privacy.

One solution: timelock transactions for a certain time, after which they become public. Certain trades only need to be private for a very short time. Government records sometimes are made public decades after the fact. Certain private transactions you may want private forever.

Final thought: sometimes the farther out in Brooklyn you go, the more interesting it gets.

Michael Long is helping Sommelier.Finance develop strategic partnerships. We are looking for front ends and bags, big and small, that want to earn yield in products they can trust.

More articles

Is Speculation Killing Crypto’s Future?

Sommelier's Path Forward: Embracing Revenue Over Narrative

Sommelier January Update

Sommelier Upgrades Cellar Architecture to Enable the Most Powerful DeFi Strategies in the Market

Real Yield USD is Coming to Maximize Stablecoin Yield

Retrospective on 2022 and the Journey Ahead

FAQ - Patache Digital’s Steady Strategies

Patache Digital: Risk Management Discussion

Strategy Deep Dive: Patache Digital

Strategy Provider Spotlight: Patache Digital

User Guide: How to Participate in Strategies on Sommelier

Sommelier Ambassador Program

Strategy Tokens: What Are They and How Do They Work?

6 Core Principles of Sommelier

10/10/22 - Deep Dive on Cleargate Backtesting

Strategy Provider Spotlight: Seven Seas

Deep Dive on Trend and Momentum Strategies

Strategy Provider Spotlight: ClearGate

Supporting Strategy Providers on Sommelier

Sommelier Protocol Team Weekly Update #11

ELI-5 Explanation of the Data Science behind Sommelier’s First Aave Cellar

Sommelier Protocol Team Weekly Update #10

The Data Science Behind Sommelier’s First Aave Cellar

Sommelier Protocol Design Documents

Sommelier Protocol Team Weekly Update #9

Sommelier Protocol Team Weekly Update #8

Sommelier Protocol Team Weekly Update #7

Twitter Spaces With Sommelier: How to Launch a Cellar on Sommelier

Twitter Spaces With Sommelier: Protocol Upgrade and Community Update

Sommelier Protocol Team Weekly Update #4

Sommelier Protocol Team Weekly Update #6

Twitter Spaces With Sommelier: SOMM Airdrop Proposal Data Analysis

Twitter Spaces With Sommelier: Community Update on the First Cellars to Launch

Twitter Spaces With Sommelier: Exploring NFT Cellars

Sommelier Protocol Team Weekly Update #1

Sommelier Protocol Team Weekly Update #2

Sommelier Protocol Team Weekly Update #3

Three Things You Need to Know About Sommelier Governance This Week

Sommelier On the Road: PROOF OF…REPUTATION

Introducing Ukpai Ugochi - Working on The Sommelier Cellars Rebalancer

Sommelier Announces 23MM Series A Mainnet Round to launch Automated DeFi via the Cosmos

Twitter Spaces With Sommelier: Mainnet Launch & Gravity Bridge

Twitter Spaces With Sommelier: Introducing SOMM Tokenomics

Twitter Spaces With Sommelier: Mysten Labs AMA With Evan Cheng

Introducing SIPS and Sommelier’s Governance Structure

Twitter Spaces With Sommelier: End of Year AMA 2021

Twitter Spaces With Sommelier: Intro to SIPS & Lisbon Blockchain Week

Twitter Spaces With the Sommeliers: Mainnet Update and Governance Launch

Sommelier Partners With Mysten Labs to Make Sommelier and All Cosmos Blockchains the Fastest Protocols on the Planet

Twitter Spaces With the Sommeliers: Sushi AMA With Joseph Delong

Introducing the Sommelier Network Mainnet and Ethereum Gravity Bridge

The Top Five Features of the Sommelier Protocol

Call for Validators: The Two Step Process for 2021

Two New Features Launched to Test Liquidity Management on Uniswap v3

Uniswap v3 Remove Smart Contract Incident Post Mortem for Sommelier

Call for Validators: Road to Sommelier Mainnet

Sommelier Liquidity AMA With Yenwen and Nick From Perpetual Protocol

Sommelier Liquidity AMA With Tascha Pan From Alpha Finance

Sommelier Liquidity AMA With Loi Luu From Kyber Network

Sommelier Liquidity AMA With Alex From Peanut

Sommelier Liquidity AMA With JP From THORChain

Sommelier Liquidity AMA With Alan Chiu From OMGX Network

Sommelier Liquidity AMA With Ari From Gelato Network

Sommelier Liquidity AMA With Sunny Aggarwal From Osmosis

A Fine Sommelier Explanation of Bollinger Bands With Kevin Kennis

Sommelier Liquidity AMA With Mona El Isa From Enzyme

Sommelier Liquidity AMA With Haxor From Method Finance

Sommelier Liquidity AMA With Tor From Secret Network

Liquidity Provider Insights With Zaki Manian - Ep. 7 - DeFi Automation Space on Uniswap v3 and Where Sommelier’s Heading

Sommelier Liquidity AMA With Geralt From CyberFi

A Pairings Tutorial of Two Sided Liquidity Addition with Sommelier

Liquidity Provider Insights with Zaki Manian - Ep. 6 - Liquidity Providers Need to Gear Up for a Multi-Chain World

Three New Summer Features for Liquidity Providers

Sommelier Liquidity AMA with Tom C and Max W from Charm

Sommelier Liquidity AMA with Dereek69 & Shalaquiana from BIOPset

Sommelier This Week - June 3rd 2021: The Road to Mainnet

Sommelier Liquidity AMA with Federico Landini from DefiLab

Sommelier Liquidity AMA with Michael Egorov from Curve

Liquidity Provider Insights with Zaki Manian - Ep. 5 - A Bright Light at the End of a Long, Tough Weekend for Bitcoin

Sommelier This Week - May 27th 2021: What Aspiring Sommelier Validators Need to Know on Last Week’s Protocol and App Progress

Liquidity Provider Insights with Zaki Manian (Special Edition) - Ep. 4 - New Pairings Release

Sommelier R&D AMA With Yaniv Tal From the Graph

Sommelier Liquidity AMA with MacLane Wilkison from NuCypher

The Eight Steps to Become a Liquidity Provider with Pairings

Sommelier NFT Awards - May 18th, 2021

Pairings By Sommelier: The FAQ

Zaki Manian Breaks Down What Liquidity Providers Need to Know Under Uniswap v3

Sommelier This Week - May 6th 2021: How This Week’s Protocol and App Progress Weaves Together to Make a Product

Sommelier Liquidity AMA with Dan Thomson from InsurAce

Sommelier This Week - April 29th 2021: Weeks Away From a Taste of the Sommelier App Experience and How the Dev Team Stays on Track

Zaki Manian Breaks Down a Phase Change Liquidity Providers Need to Know About Automated Market Makers

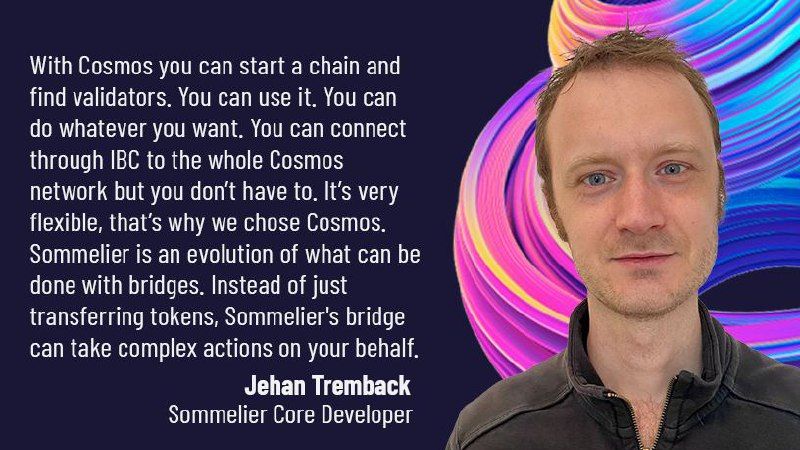

Introducing Jehan Tremback: Sommelier Core Developer and Althea Co-Founder that pushes the Limits of the Blockchain Bridge with Gravity

Sommelier This Week - April 22nd 2021: An Inside Look at Progress on Coordinating Sommelier Components That Contribute to the Chain

Sommelier This Week - April 15th 2021: Providing a Best-in-Class Experience for Uniswap Liquidity Providers

Sommelier Announces $1M R&D Grant from The Graph Foundation

Introducing LP Rewards: This Week With Cellframe

Introducing Deborah Simpier: Althea CEO and Sommelier Co-Founder Who Brought the Gravity Bridge to Life in The Cosmos

Sommelier This Week - April 8th 2021: What Uniswap v3 Means For Sommelier Architecture and Validators

Introducing Sommelier LP Rewards Program

Sommelier This Week - April 1st 2021: Gravity Bridge and Private Testnets

Blockchain startup decides to acquire a California winery and host NFT wine parties

Introducing Justin Kilpatrick: The Blockchain Bridge Wizard Who Maintains Gravity

Five Ways UniswapV3 changes the world for Liquidity Providers on the AMM

Introducing Jack Zampolin: On Becoming A Sommelier in The Cosmos

Sommelier: Welcome To The New CoProcessor For Ethereum

© 2025 Somm by Bajanss OÜ –Maakri 36-50, Tallinn, Estonia 10145